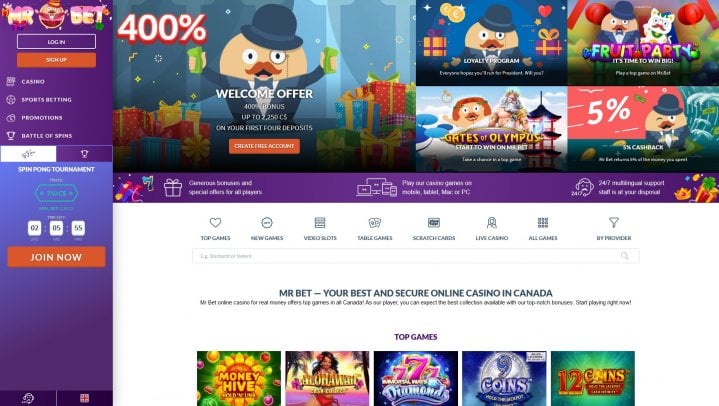

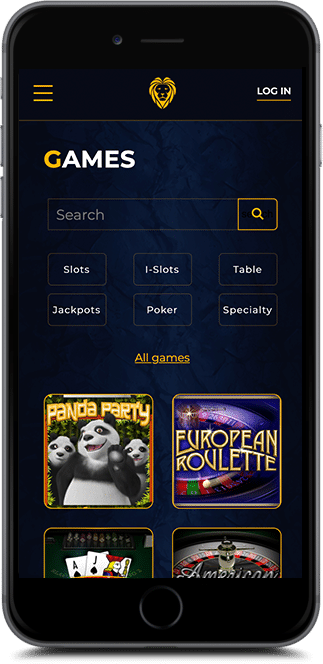

Extremely online casinos has the absolute minimum put from either $ten or $20, that’s nonetheless a decent restrict, even though you’re also on a tight budget. All of these providers give higher bonuses, so feel free to discuss her or him through all of our system. Provided a great 5 dollar minimal deposit casino Canada offer benefits, internet casino labels accept the fresh perks’ significance so you can encourage casino Fun 88 no deposit bonus users to join up and deposit. Such as rewards, including the greeting deposit extra and you can associated also offers, is somewhat impression professionals’ feeling. Our analysis away from on the web a real income casinos prioritizes certification, as it’s a crucial indication away from an internet site’s validity and you will accuracy. I see casinos which might be prior to Canadian regulations and you can report to the appropriate regulatory regulators for each and every region.

Available to owners away from AL, AR, Florida, GA, IL, In the, IA, KY, La, MS, MO, NC, South carolina, TN, and you will Texas. Open to people out of NH, MA, RI, CT, DE, New york, New jersey, PA, or Fl. Designed for owners of IA, IL, Inside the, KS, MI, MN, MO, OH otherwise WI. See the costs on every of them profile as they tend to are very different.

There are numerous the new answers to the protection deposit condition—specific was lauded because of the sensible houses advocates, while some were confronted with doubt and you may distrust—usually with good reason. What you’ll want to be cautious about will be the month-to-month low-refundable fee you can even become paying. These charge simply wade to your improving the assets pay their insurance policies therefore however could be energized money on flow-out for injuries.

You could potentially prove that you has a deeper link with a few overseas places (yet not more a couple) for those who meet all the following criteria. An expert runner who’s briefly in america to help you participate inside a non-profit football knowledge is an exempt personal. A charitable sporting events feel is but one that fits the following requirements. You would not be an exempt individual while the an instructor otherwise trainee inside the 2024 if you were exempt as the a teacher, trainee, otherwise scholar for your section of 2 of your 6 preceding diary many years. Although not, you might be an excused personal in the event the the following standards is actually satisfied.

Range step 1 – Attention earnings | casino Fun 88 no deposit bonus

Considering the San francisco’s infamously sky-large homes costs, plus the area’s homelessness crisis, it’s unsurprising that importance of help with deposits regarding the urban area much outstrips the production. The newest Homes Trust out of Silicon Valley, a san francisco bay area area invention standard bank, features a grant program particularly for helping somebody experience homelessness inside the space manage protection places. The newest Ultimately House Deposit System are financed from the Used Information Silicone Area Turkey Trot, a yearly 5K one draws particular ten,000 so you can 15,100000 athletes. Property Faith spends the part of the money in order to honor you to definitely-date has as high as $2,five-hundred from the put program to help individuals hop out homelessness from the coating initial moving can cost you. And even though dumps are by the meaning refundable, there’s zero make sure clients gets that money back, whether or not it shell out the rent and get rid of the unit well.

That it merely boasts transportation income that is managed while the based on offer in the us if the transportation initiate otherwise finishes in the us. To have transportation earnings out of private features, the newest transport need to be between your You and you can an excellent U.S. territory. Private services out of a good nonresident alien, so it just pertains to income produced from, or perhaps in connection with, an airplane. But not, if you have a direct economic matchmaking involving the carrying of the brand new resource and your change otherwise company to do individual functions, the cash, gain, otherwise losings try efficiently linked.

Figuring Your own Tax

When you are a worker and you receive earnings susceptible to U.S. tax withholding, you are going to generally file because of the fifteenth day of the newest 4th few days after their tax 12 months finishes. For the 2024 season, file your own get back because of the April 15, 2025. You need to file Mode 1040-NR while you are a twin-position taxpayer which gives right up residence in the united states through the the entire year and you can who is not a U.S. resident to your history day’s the fresh taxation seasons.

- If you are a citizen out of Mexico or Canada, or a national of the All of us, you can allege each of your dependents whom matches specific tests.

- The decision to getting handled because the a resident alien are suspended for your tax year (pursuing the income tax 12 months you have made the choice) if the neither partner are an excellent U.S. resident or citizen alien any time in the income tax year.

- If you qualify for which election, you possibly can make they from the processing a questionnaire 1040 and you can tying a signed election report for the go back.

- This informative guide stops working common things renters deal with and you can teaches you exactly how various other condition laws and regulations protect tenants like you.

- You need to document Function 8938 in case your overall property value the individuals possessions exceeds an enthusiastic applicable endurance (the new “revealing threshold”).

What’s more, it has an excellent 35x choice standards, which makes it easier to own people to fulfill the fresh standards and bucks-away their income instead difficulties. The newest Harbors Local casino embraces The newest Zealand people which have an tremendous added bonus package around NZ$step one,500 in just a good NZ$5 deposit. If the financing progress and dividends is efficiently linked to a U.S. exchange or business, he or she is taxed with regards to the same laws and also at the newest exact same prices one affect You.S. citizens and you can owners. When you’re an excellent You.S. resident otherwise resident and you love to eliminate your own nonresident mate as the a resident and you will file a joint taxation go back, your own nonresident partner needs a keen SSN otherwise a keen ITIN. Alien partners who’re claimed because the dependents are also necessary to give a keen SSN otherwise ITIN. If you are not an employee who obtains wages at the mercy of You.S. tax withholding, you should document by 15th day’s the brand new sixth few days once your income tax year comes to an end.

If a property manager fails to spend the citizen attention, they’re fined around $100 per offense. But not, property professionals don’t need to spend residents attention for your week in the event the citizen are 10 or maybe more weeks late using lease and you can was not billed a later part of the fee. Since the a property owner in the Connecticut, getting well-advised in regards to the latest shelter put laws isn’t only sound practice—it’s a cornerstone of your business’s trustworthiness and you may legal compliance.

U.S. Bank account to have Canadians

Some claims allow it to be landlords to help you charge a lot more, but close functions’ market rates usually is out there. If you are section of a good HUD rental direction system, the defense deposit may be as little as $fifty. For many, delivering security deposits back is not just a “sweet topic” to take place otherwise just a bit of “enjoyable money.” It’s money wanted to help security swinging costs. Of several renters get furious when trying to obtain their put straight back. In the event the certain types of write-offs, conditions, and you may loans are claimed, the new home otherwise trust can be susceptible to California’s AMT. Get Schedule P (541) to figure the amount of taxation to go into online 26 to possess trusts which have either citizen otherwise low-citizen trustees and you may beneficiaries.

Publication 519 – Additional Matter

Because of this there will be no withholding from societal protection or Medicare taxation in the shell out you will get for these services. These services are very restricted and usually were just on-campus works, simple education, and you can economic difficulty employment. A distribution by a QIE to help you a great nonresident alien shareholder one to are managed as the acquire regarding the sales otherwise exchange from a good You.S. property attention because of the shareholder try subject to withholding in the 21%. Withholding is additionally necessary to the certain withdrawals or any other purchases by the domestic or international businesses, partnerships, trusts, and you will estates. When you are an excellent nonresident alien performer otherwise runner undertaking or participating in sports occurrences in the us, you are able to enter a great CWA to your Internal revenue service to possess smaller withholding, provided the needs try fulfilled.

Certain foreign-origin funding money such focus and you may financing gains can be susceptible to taxation. For more information on Paraguay’s business taxation, legal design and you will taxation treaties, here are a few incorporations.io/paraguay.This will never be construed since the taxation suggestions. I have use of a major international community of accredited attorney and you may accountants who will offer the right advice for your unique points. If there’s no personnel-company relationships between you and anyone for who you perform features, the settlement is actually susceptible to the newest 31% (or lower treaty) speed away from withholding. A binding agreement which you arrived at to your Internal revenue service from withholding out of your payment for independent personal services is very effective for payments shielded because of the arrangement just after it’s offered to by the all of the events. You should invest in fast document a taxation come back for the present day income tax season.

Personal shelter and you can Medicare fees commonly withheld out of buy so it functions except if the newest alien is considered a resident alien. When you are a great nonresident alien briefly acknowledge to the United Says because the a student, you’re generally maybe not allowed to benefit a wage or salary or even to take part in company if you are in the United states. Sometimes, students accepted to your United states inside “F-step 1,” “M-step 1,” otherwise “J-1” status try granted consent to be effective.